In any industry where customers are holding funds—such as in gaming or those pertaining to financial services—service providers are required to implement and run detailed KYC (Know Your Customer) checks on prospective and existing customers. During the KYC process, users are required to provide different information, such as personal details, address history, etc. and be able to explain the source(s) of their funds.

From a customer experience standpoint, this can result in a long journey with various input methods required such as documents scans, live video/image capturing and so on. Likewise, from the business perspective a cumbersome, lengthy and input-heavy KYC process inevitably results in lower conversions as the user faces challenges in completing the journey and could drop out before completing sign-up and depositing funds and completing trades.

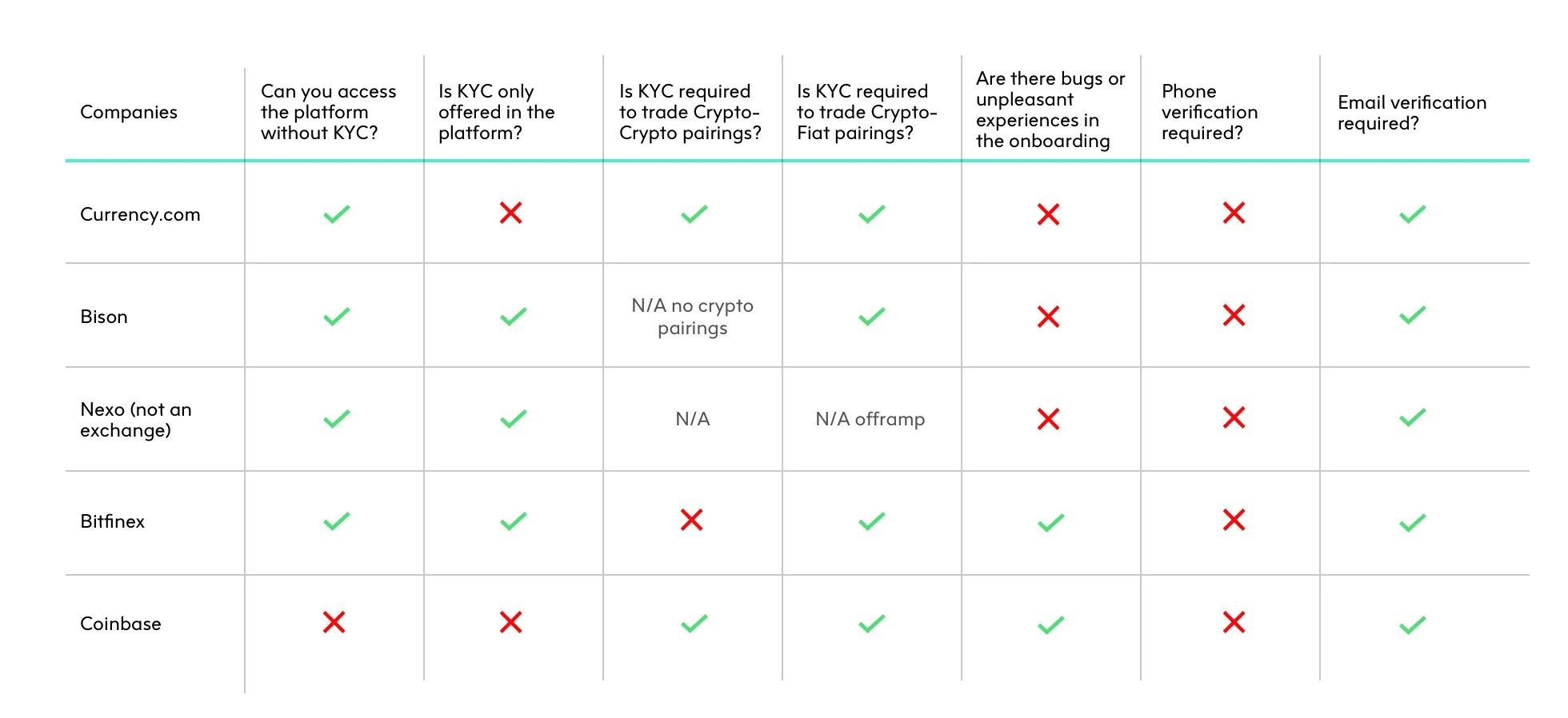

Here we’ll look at the onboarding processes of five leading crypto exchanges, namely Currency.com, Coinbase, Bison and Bitfinex, and the cryptocurrency lending company Nexo. This is not an exhaustive analysis of the top exchanges; the emphasis is on exploring the different ways these exchanges and similar vendors are tackling customer onboarding.

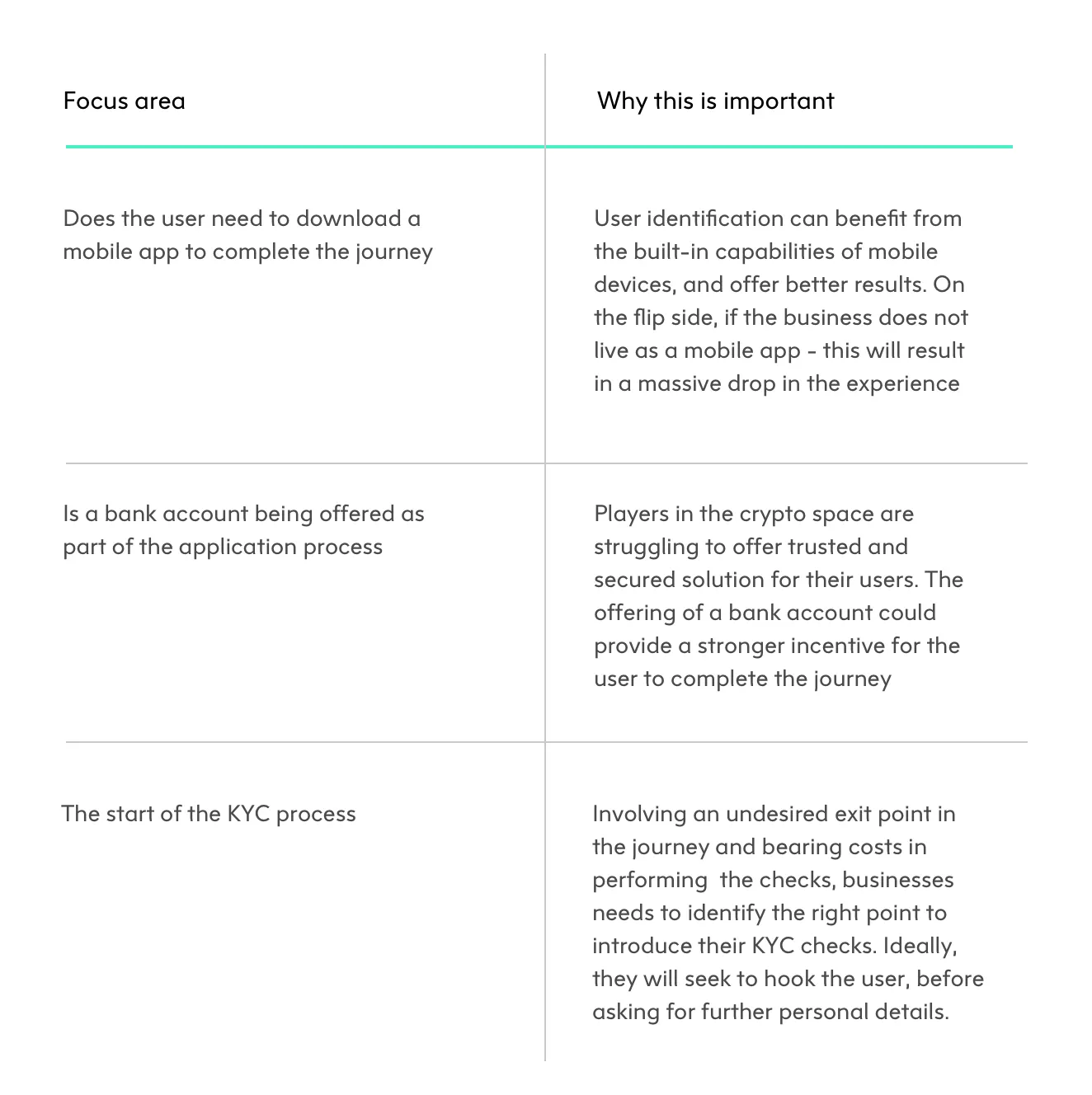

Our analysis focused on a number of areas, which when combined help to determine what a good user experience can look like, as well as giving the exchanges an overall score:

Context: The challenge of KYC in crypto

KYC is no longer a simple compliance box-ticking exercise. Maintaining compliance is increasingly complex as regulatory requirements increase so frequently, and the threat of fines is a very real one—from falling foul of AML, MiFID II, CRS, PSD2, FATCA, GDPR and regular policy changes. Clearly, nowhere does this regulatory environment present more challenges than in the emerging crypto/digital asset sector. With more and more players in the crypto space aiming to get licensed by the formal authorities, and offer higher security measures to their end users, players both big and small are interested in performing bank-standard checks of their clients.

KYC also impacts the costs of operating in the form of compliance costs, margins and profits. There are significant resource requirements to undertake due diligence, which erodes profit margins, and the existing disjointed, legacy processes can be manual and expensive. It’s such an issue that in parallel industries financial institutions are now offering as a service whitelabel onboarding with automated KYC, screening, ongoing due diligence and so on.

KYC also affects operating costs indirectly in terms of acquisition costs, or Life Time Value to the Cost of Acquisition (LTV:CAC). Customers of crypto exchanges need smooth digital UX to complete their onboarding, as manual or otherwise time-consuming processes lead to a poor customer experience, and even the loss of a customer.

Trend: exchanges are not asking customers to complete KYC for access

Many of the exchanges analysed here allow customers to initiate the KYC/verification process after they already have access to the platform. From a purely UX perspective, this is a great way to give the customer a feel for the platform and the breadth of currencies. It also avoids the potential rise in customer acquisition costs from a time-consuming KYC process. The customer can then initiate the KYC process when they are ready to begin trading on the given platform, and when they have the requisite ID to hand.

This also makes sense for a couple of reasons, given the fact that traders will most likely be accessing multiple exchanges for different purposes, and thus there is no immediate need (unless there is a need for a new or 'altcoin') to undergo the KYC process.

However some exchanges are opting to roll out KYC verification across the board for any kind of access. Coinbase—one of the larger and more well-known exchanges—requires customers to complete KYC before any kind of access is granted.

We can speculate on why this might be. Exchanges may be understandably nervous of shifting regulation, and wish to be KYC-compliant from the get-go for simplicity. Additionally, they may have different opinions on when to ‘convert’ a lead to a fully-fledged customer; some will rationalise that it’s better to get it out of the way on initial sign-up, while others will feel that allowing potential traders to navigate the platform first will help them to convert, they may also feel that they can't get away with mimicking the large exchanges who will have a better perception.

Coinbase tackle the inevitable drop-off at the last stage of the marketing funnel by following up with emails it reminds users to sign up at their convenience, which is now an almost universally observed trend.

In-detail: Currency.com onboarding (9.5/10)

Based in Belarus, Currency.com is the self-described first ever ‘tokenized securities exchange’, allowing investors to directly trade and invest in tokenised financial instruments, with payment being made directly in Bitcoin (BTC) or Ethereum (ETH) on a European-regulated exchange. As well as this exchange offering, customers can make use of a secure wallet and crypto storage, and customers can buy crypto with fiat.

Onboarding can be completed entirely via a mobile app or web, with KYC completed later on to complete sign-up i.e. if a customer wants to make use of the trading capabilities. To further speed up onboarding, they use phone location to pre-populate geographical forms (e.g. Residence and Nationality), while the customer is kept aware of their verification status within the app (e.g Upload ID, Set up 2FA).

All in all, Currency.com’s onboarding is flawless.

All in all, Currency.com’s onboarding is flawless, along with a neat prompt to refer a friend at the initial account creation layer.

In detail: Bison onboarding (8/10)

Bison is a cryptocurrency trading app backed by a traditional securities exchange—Börse Stuttgart—where trading is free of charge and the trading of Bitcoin, Ethereum, Litecoin and Ripple (XRP) is possible. Bison are based in Germany, and adhere to domestic compliance laws, which makes features like video identification possible, as they are admissible under German KYC regulation.

Bison is strictly mobile-only, existing only as an app. As such, they have taken the opportunity to make the most of mobile-centric UX elements, such as Touch ID, push notifications relating to the setup, and a tutorial within the app.

With basic access gained before completing KYC, users then complete KYC within the secure part of the app, while there is an extensive demo mode that can be explored before completing the KYC steps.

In detail: Nexo onboarding (7.5/10)

Finally, while not strictly speaking an exchange, Nexo are relevant to our analysis as they share many of the same parameters as the exchanges analysed here in their onboarding flow. For example they have KYC as part of their onboarding process and are tackling this in some interesting ways, so is worthy of analysis.

Positioned as “better than any crypto wallet, exchange wallet, bank account” Nexo allows customers to borrow instantly in 40+ fiat currencies and earn daily interest on idle assets.

KYC is completed once users access the secure part of the platform. Nexo uses Onfido for KYC, with KYC typically completed within a few minutes. Nexo have tiered levels of access, each with its own limits and respective levels of KYC verification. These levels enable users to operate anywhere in the range of $20,000 to $2,000,000 a day.

Other UX highlights worth mentioning include allowing customers to select from multiple languages during the registration process—a nice touch that is usually missing. From there, once customers are in the platform, they are shown what the next steps are to begin using the product. However, non-US numbers do not appear to receive an SMS code for verification, which could prove to be a significant pain point.

In detail: Bitfinex onboarding (5/10)

The cryptocurrency exchange Bitfinex is something of a pioneer in the crypto exchange space, and as such has evolved with crypto trading itself. While based in Hong Kong, they are registered in the British Virgin Islands, whose evolving regulation demands they adhere to, in ways that have become increasingly apparent in the shift in the ways they approach KYC.

Unlike some of the other exchanges in this list where KYC can be completed in minutes for most deposit/withdrawal limits, at the time of writing Bitifinex have an extremely long potential verification processing time, estimated at 6-8 weeks rather than hours or even days. They have stringent KYC requirements, including requiring two forms of Government-issued ID. However, verification is only required for Fiat on/off ramping.

This intense verification process may be explained somewhat by the storied history Bitfinex have gone through, so it remains to be seen how their process continues to evolve. At the time of writing, they remain one of the largest exchanges by trade volume, despite the barriers to entry for new traders to the platform.

In detail: Coinbase onboarding (6/10)

Coinbase is a digital currency exchange based in San Francisco, which maintains a banking relationship with Barclays. Unlike the other exchanges analysed here, Coinbase requires customers to verify themselves before providing any access to the platform.

The onboarding UX is not flawless. While the GDPR opt-in is clear and transparent, it feels tacked on, at the same stage as validating email and password—with the password not validated until after, potentially sending you back to start again if your password doesn’t meet Coinbase’s requirements. During the KYC process, error messages bring customers back to the homepage, and the experience can be buggy when selecting mobile verification on desktop.

There is one page for personal information and to provide the reason for opening an account and providing the source of funds, and this all happens before access is granted. Clearly, as a potential market leader Coinbase is keen to follow KYC to the letter, and position the exchange to be the most trusted place to buy and sell cryptocurrency, but this can make for a relatively clunky and time-consuming first experience.

Only some exchanges are getting onboarding UX right, and regulation is making it harder.

KYC is mandatory for the deposit and withdrawal of fiat money in almost every market, and all of the exchanges reflect this—some with tiered access based on the amount of funds deposited or withdrawn. The exchanges are tackling KYC in very different ways, with some excelling in the current climate, while others struggle to onboard new users in regard to the rapidly shifting regulatory environment.

Of the platforms analysed, Currency.com has the closest to what can be described as a delightful onboarding experience. It takes just a few minutes to complete, with services like chat, a progress bar for verification status, and intelligent use of GPS coalescing for a very comprehensive end-to-end experience.

Some of the emerging trends in how and when the exchanges verify customers seem like a result of crypto ‘going mainstream’—with the exchanges operating as a means for traders to turn their fiat into crypto and vice versa. The exchanges can then hold the assets for them, both increasing the exchange’s market share of customers, and innate value. This is bringing about shifts in their UX and how they tackle onboarding, and this is likely to continue.

Image credit: Samuel Zeller for Unsplash