Building a fully licensed corporate neobank

Summary

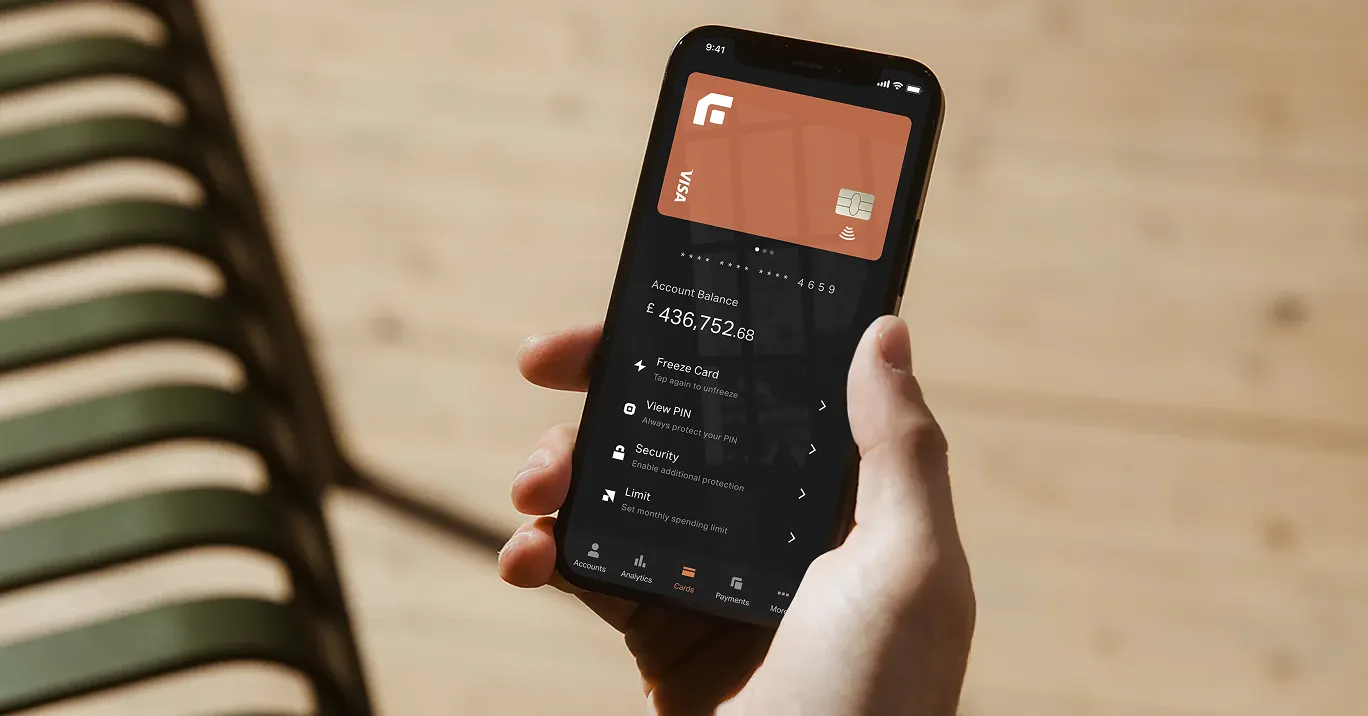

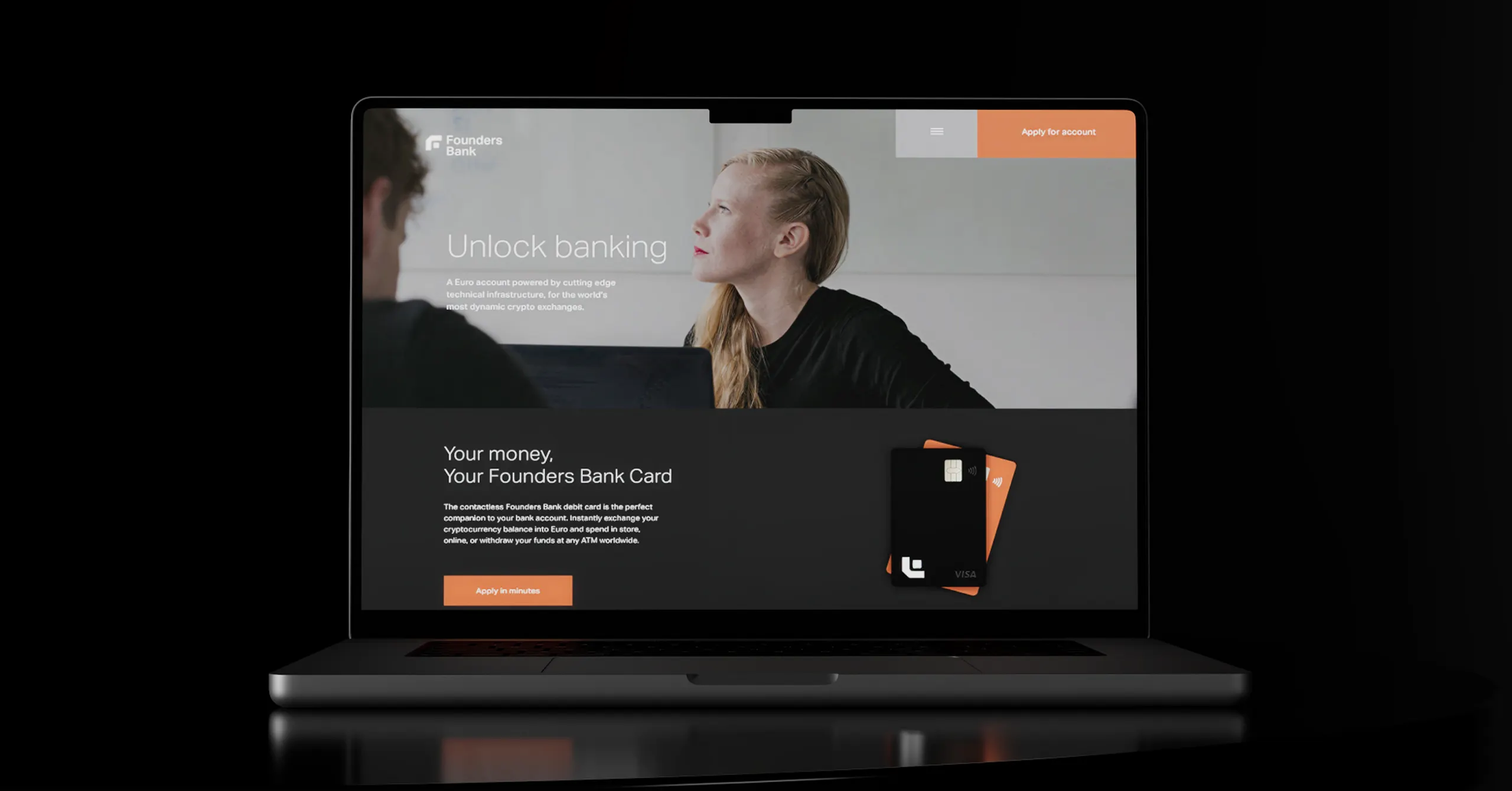

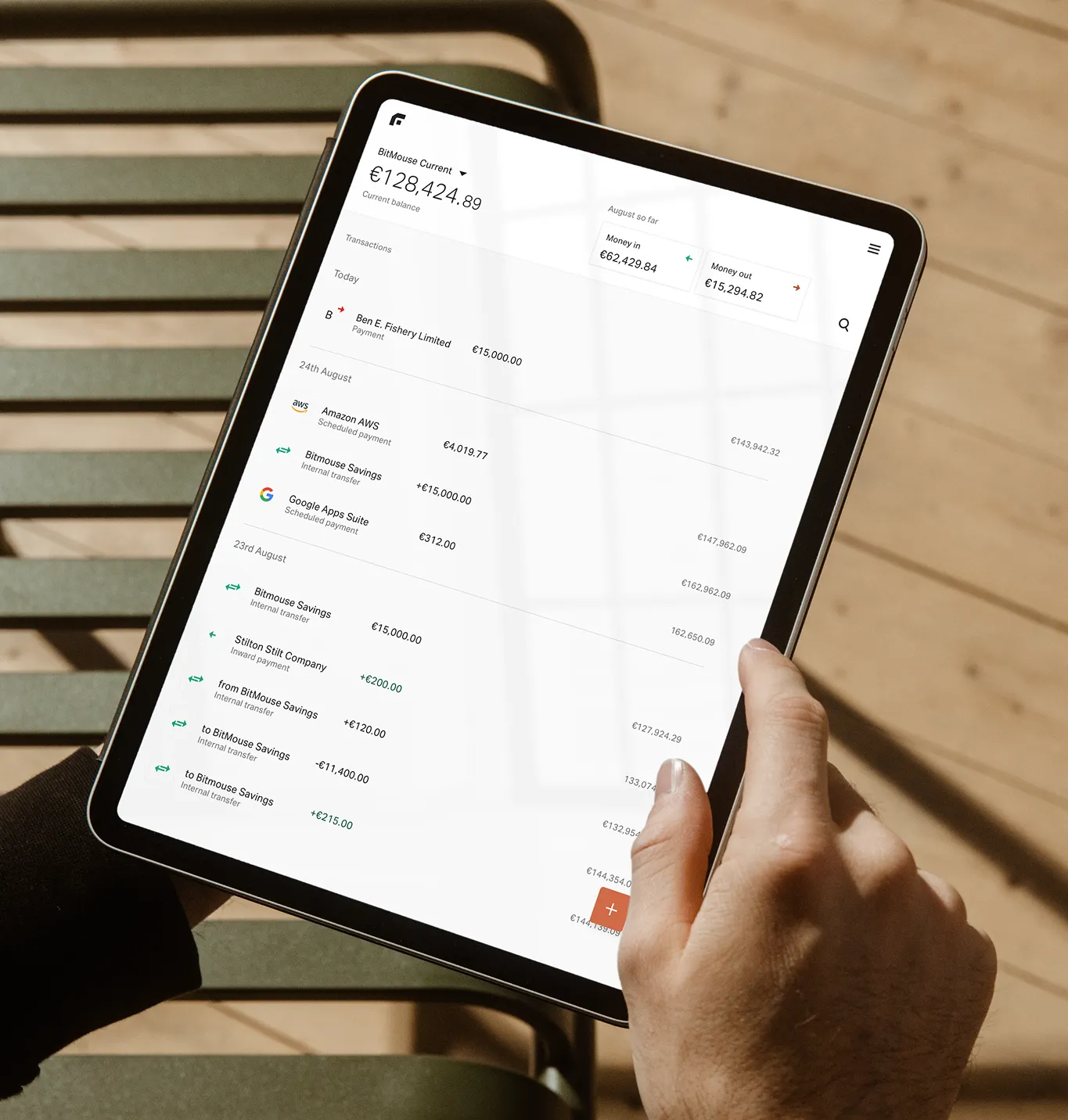

Founders Bank aims to be the go-to bank for founders and their businesses. We led on helping them create a lean and agile challenger bank with a focus on crypto-driven sectors. We devised the digital strategy, delivered end-to-end implementation across product, technology, and both the brand and product design.

Outcomes

- Creating banking services for crypto driven sectors

- Account connecting fiat and crypto

- Propositions tailored to the audience

- End to end digital bank CX design

- The brief

- A digital-first corporate bank, built from scratch

An entrepreneurial team of seasoned banking executives approached us with a challenge: define and deliver a full-stack, fully licensed corporate bank for the next generation of business founders—especially those in fast-moving, tech-native sectors.

We were brought in to make it real: the product, the brand, the technology, the strategy—and crucially, a roadmap that could win over regulators and customers. In 12 weeks, we built the foundations for everything to follow.

Discovery & Strategic Design

A 360° definition of a modern banking platform

We ran a 12-week Discovery phase covering four essential areas:

Product Strategy & Value Proposition: Turning the stakeholder vision into a desirable, viable and feasible business model.

Brand Design: Crafting a scalable, digital-first identity aligned to the needs of modern founders.

Technology & Architecture: Designing a composable, secure and scalable infrastructure across all core domains.

Execution Readiness: Creating a detailed roadmap to guide the Implementation phase—with every decision documented and regulator-ready.

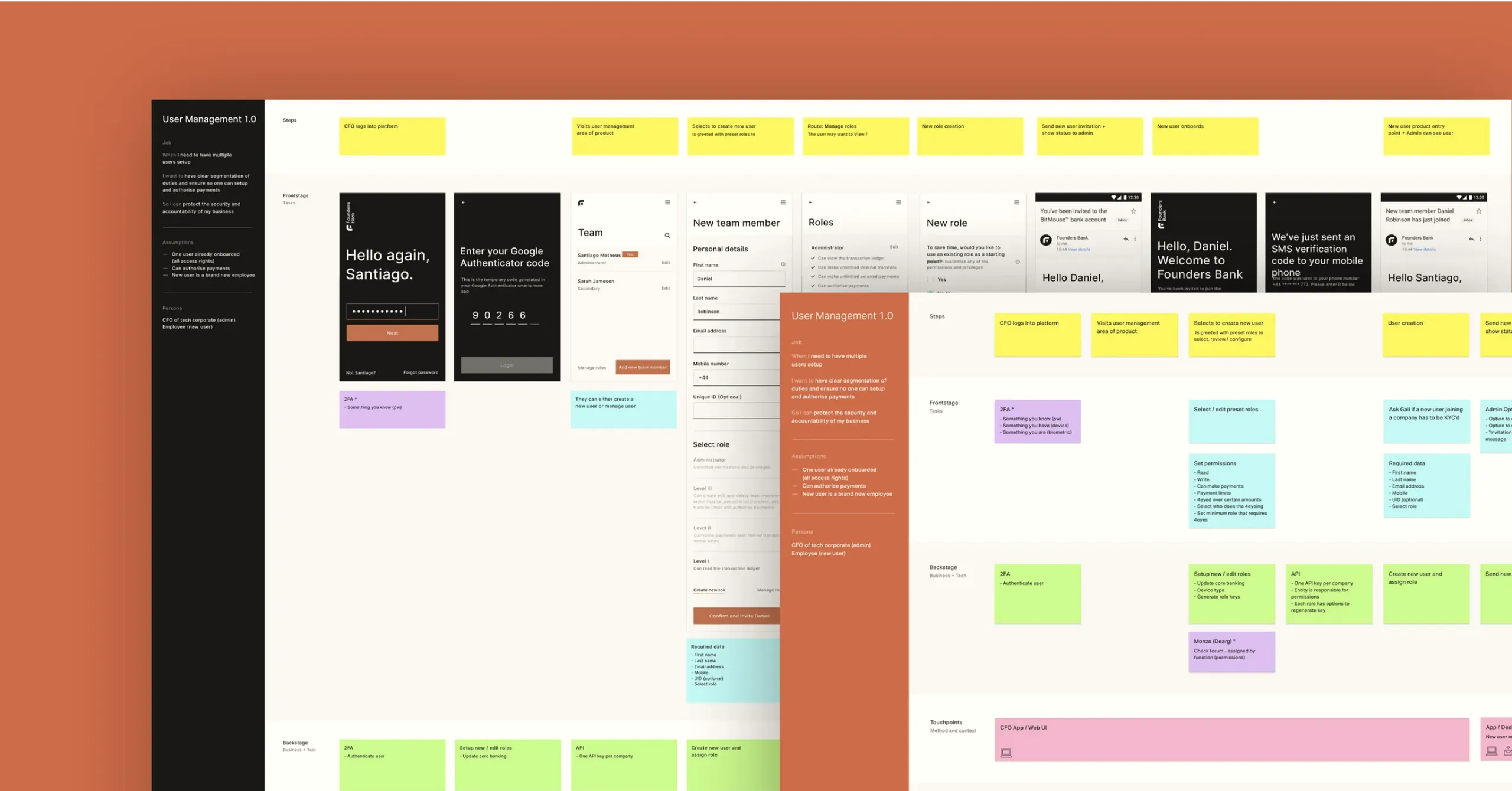

We worked horizontally across the product—customer journeys, backend workflows, vendor integrations—and vertically into specific technical decisions, from identity management to KYC/AML flows.

Customer Research

Grounding the proposition in real-world needs

The bank’s leadership—made up of investors, partners and other senior stakeholders—held a strong vision on how they could provide value for this underserved segment, but crucially these were just assumptions that would need to be challenged and turned into a robust proposition. We conducted 40+ in-depth interviews with founders, CFOs, and finance leads, using the Jobs To Be Done framework to surface unmet needs and friction points in existing business banking.

The research revealed 10 distinct “jobs” founders were hiring their bank to do—from managing crypto liquidity to streamlining onboarding across global teams. These insights reshaped the product roadmap, challenged initial priorities, and focused effort on what mattered most.

Technology & Vendor Strategy

Buy, build, or partner—by design

To deliver at speed without compromising long-term flexibility, we ran a full build-vs-buy assessment across the platform. Where third-party vendors made sense, we handled technical due diligence: inspecting API maturity, compliance alignment, and performance guarantees. Where custom builds were necessary, we defined detailed specifications and integration paths.

Our architecture was API-led and modular—built for orchestration, not lock-in. Core services were segmented cleanly from edge components, making it easy to swap out tools, launch new features, or expose services externally.

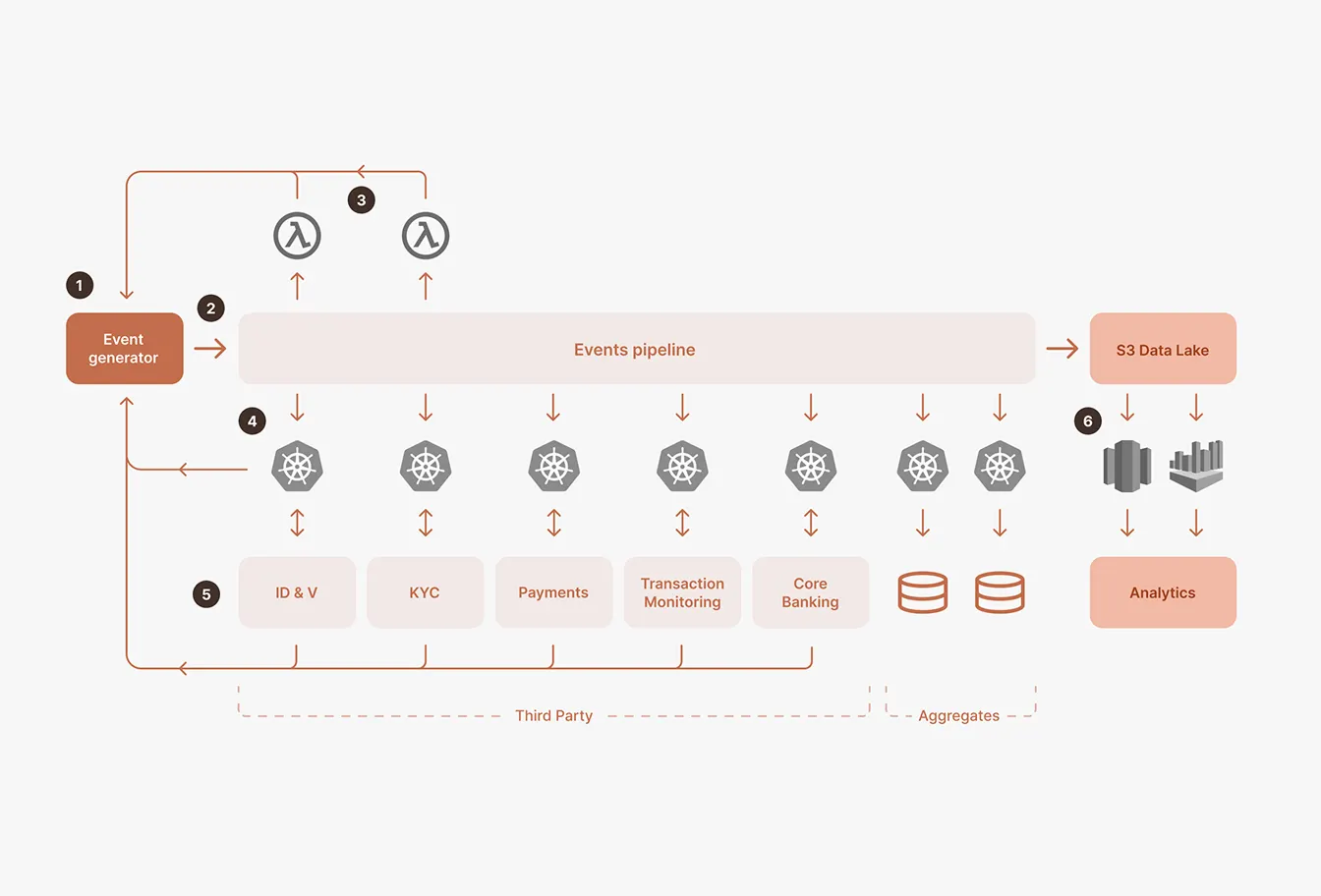

SOLUTION ARCHITECTURE APPROACH

Event-driven microservices design

We designed an event-driven architecture built on Kubernetes for scalability and fault-tolerance. Services were built as independent, composable microservices—each observable, restartable, and horizontally scalable. Key principles included:

Event history as a compliance asset: Events were timestamped and traceable, allowing the platform to replay history for audit purposes.

Resilience by design: Failures in third-party services were isolated through queuing strategies and fallback patterns.

Security built-in: Message encryption, cluster boundary controls, and a zero-trust approach to service communication.

We kept the core banking platform isolated, allowing product layers to evolve independently. No distributed monoliths. Just clean, scalable services.

Outcomes

A founder-focused bank—ready to scale

By the end of our engagement, Founders Bank had:

40+ stakeholder & customer interviews with clear user needs

10 core Jobs To Be Done identified

Custom KYC/AML framework for crypto-native businesses

Modular microservices architecture

Feature prioritisation & product roadmap

High-fidelity design system, brand, and prototype

Integrated SaaS + bespoke components, with vendor selection and due diligence

Agile product, design, and engineering team embedded through implementation

And most importantly: a clear, cohesive plan to launch a challenger bank in one of the most complex—and exciting—sectors in fintech.