Creating a digital platform to transform SME finance

Our client, a leading independent alternative investment manager and private equity firm, works to build a portfolio of high-growth, sustainable businesses that deliver a compelling proposition – supporting them with expertise and capital to drive growth.

Recently, the firm identified the potential for a new digital service, targeted at SME businesses. Elsewhen worked on a proof-of-concept to explore how this service could work, in terms of a value proposition, service design and technology strategy. Together we created a viable digital tool to empower SMEs.

Highlights

- Building a viable business proposition for an underserved market.

- Creating a proof-of-concept (POC) and accompanying strategy, plus front-end design and full brand.

- The challenge

- Proving the business value of a new digital opportunity

The SME (small and medium-sized enterprise) business segment is very broad, ranging from sole traders to companies with £25m turnover and hundreds of employees. However, SMEs have usually been under-served by major banks and finance providers.

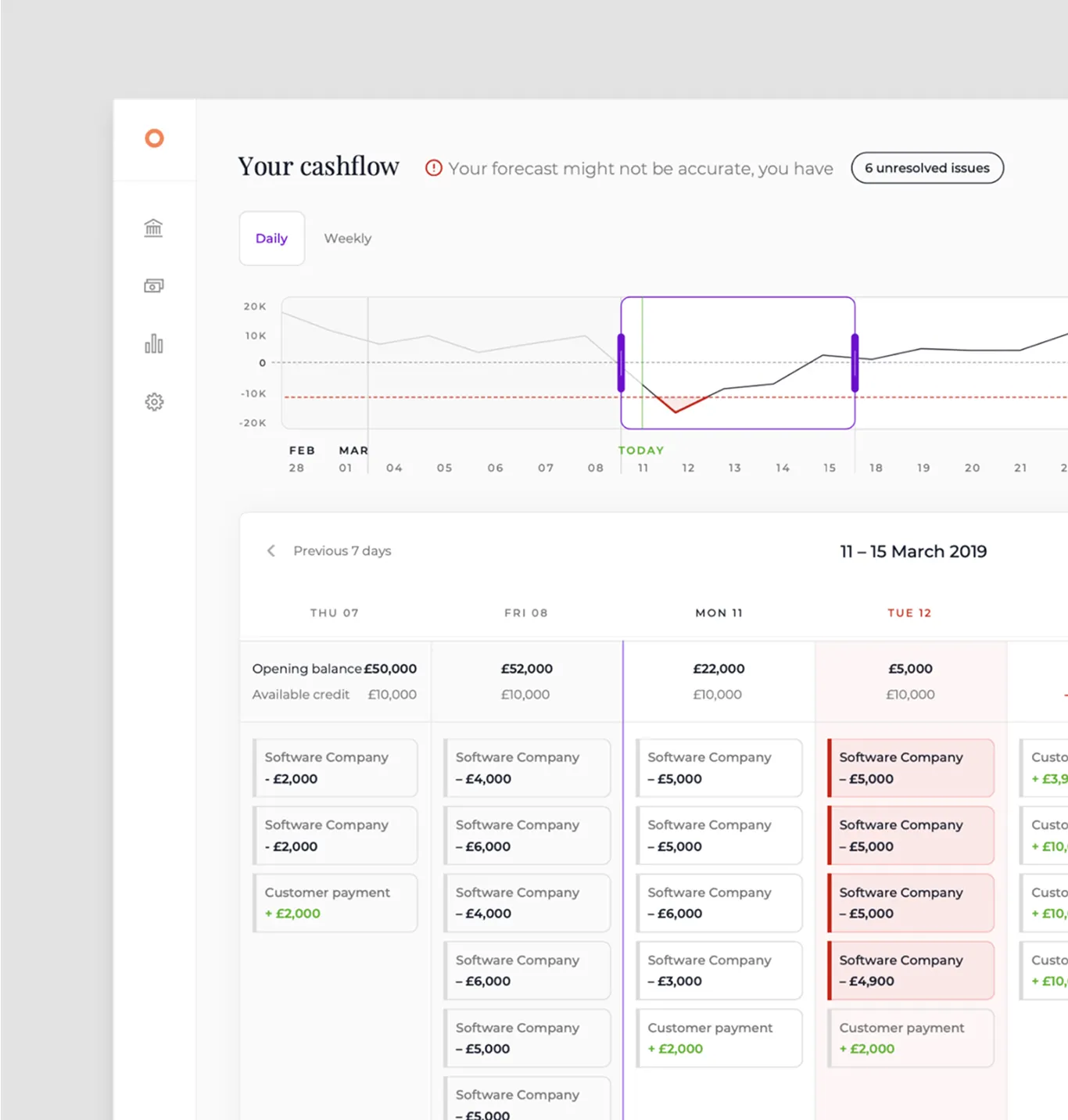

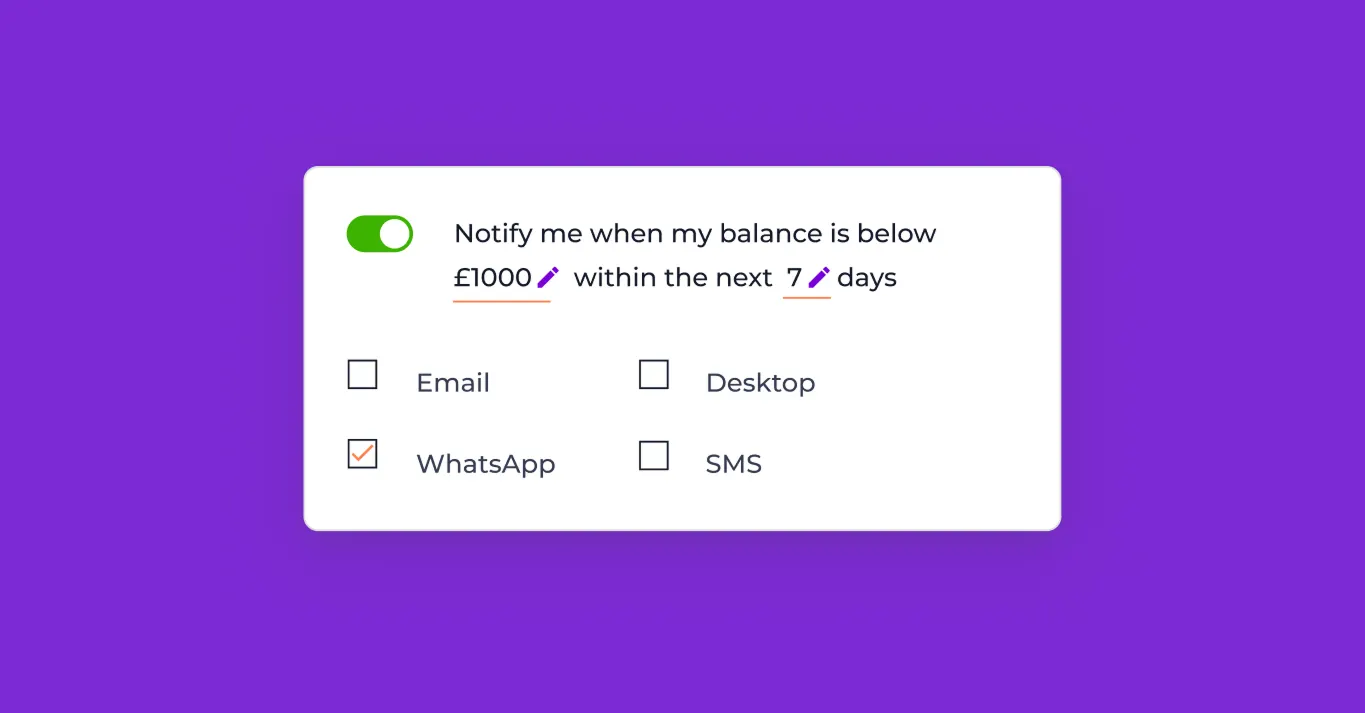

While enterprise organisations are offered a wide range of services to help them manage and grow their assets, few providers are willing to offer these services to SMEs, Moreover, there are few solutions that offer SMEs a consolidated view of their bank and accounting data, cash flow forecasting, or services to aid decision-making.

Our client saw the opportunity for a new finance management platform for SMEs, giving a clear end-to-end overview of cash flow – and providing access to a full range of tailored financial services.

Our services

Value proposition creation

Product architecture

Customer insights & JTBD analysis

Technical solution architecture

Vendor due diligence

Data modelling

MVP & Roadmap creation

Product Design & Prototype creation

Lean branding

Our approach

Understanding the financial needs and pain points of SMEs

To build the business case, we researched market sizing, customer needs, competitor landscape, and possible opportunities. We decided to focus this platform on the financial management needs of larger SMEs with significant turnover, complex cashflow and in-house finance staff.

Elsewhen worked closely with our client, building out a value proposition, service design and user interface concepts – to show that the platform idea had the potential and value to be taken forward to market.

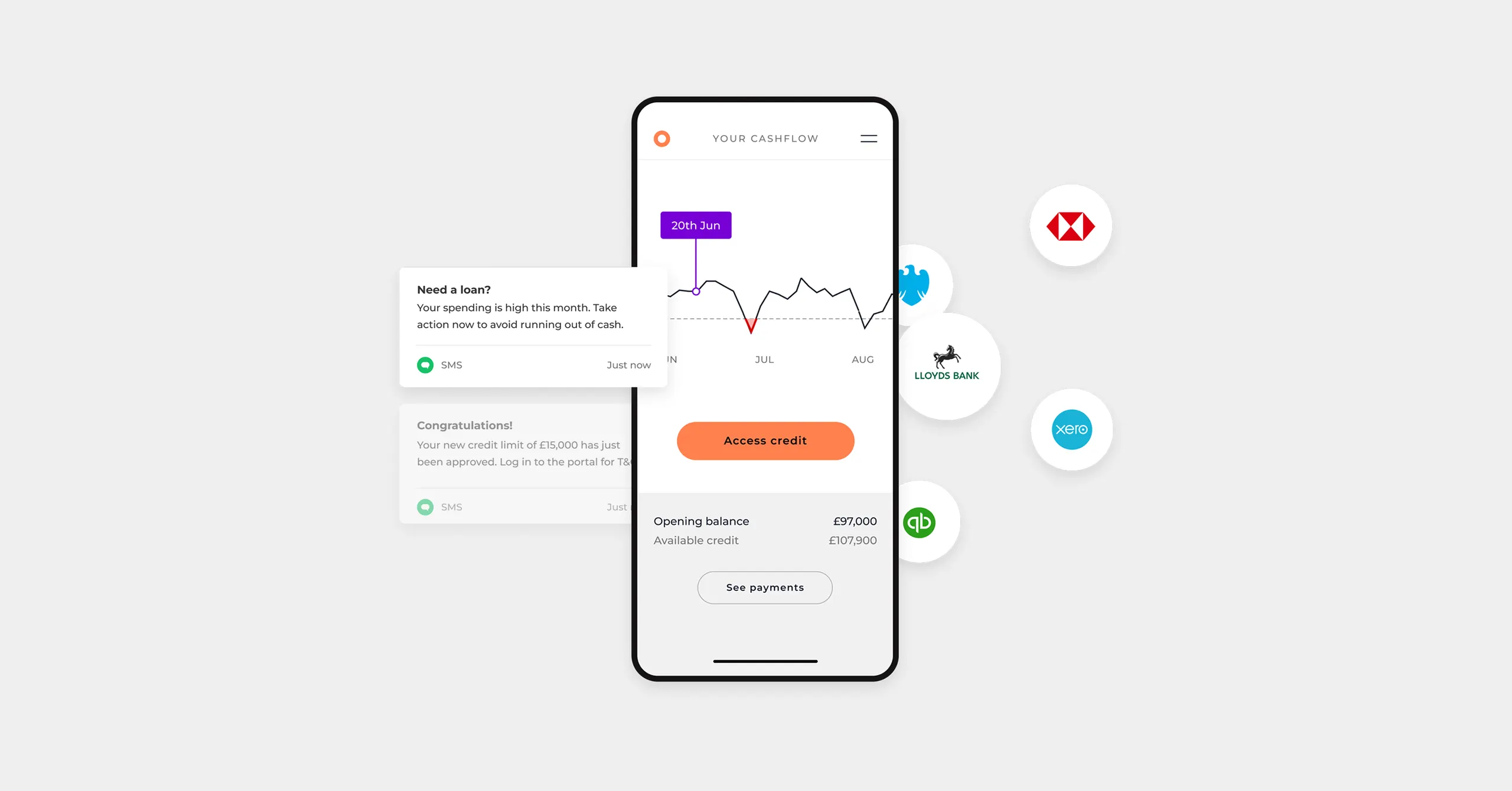

Our design team visualised a prototype solution for a digital ‘one-stop-shop’ for SME banking and finance. We also identified, assessed and shortlisted technology partners and financial service providers who could enable the platform's core functionalities.

The solution

Designing and delivering an implementation-ready digital product

Elsewhen designed and developed a viable proposition to bring to market and evolve with ready customers: We delivered a full proof-of-concept, design and product strategy, as well as a project wiki recording the insights captured during the discovery process, competitor research and user testing:

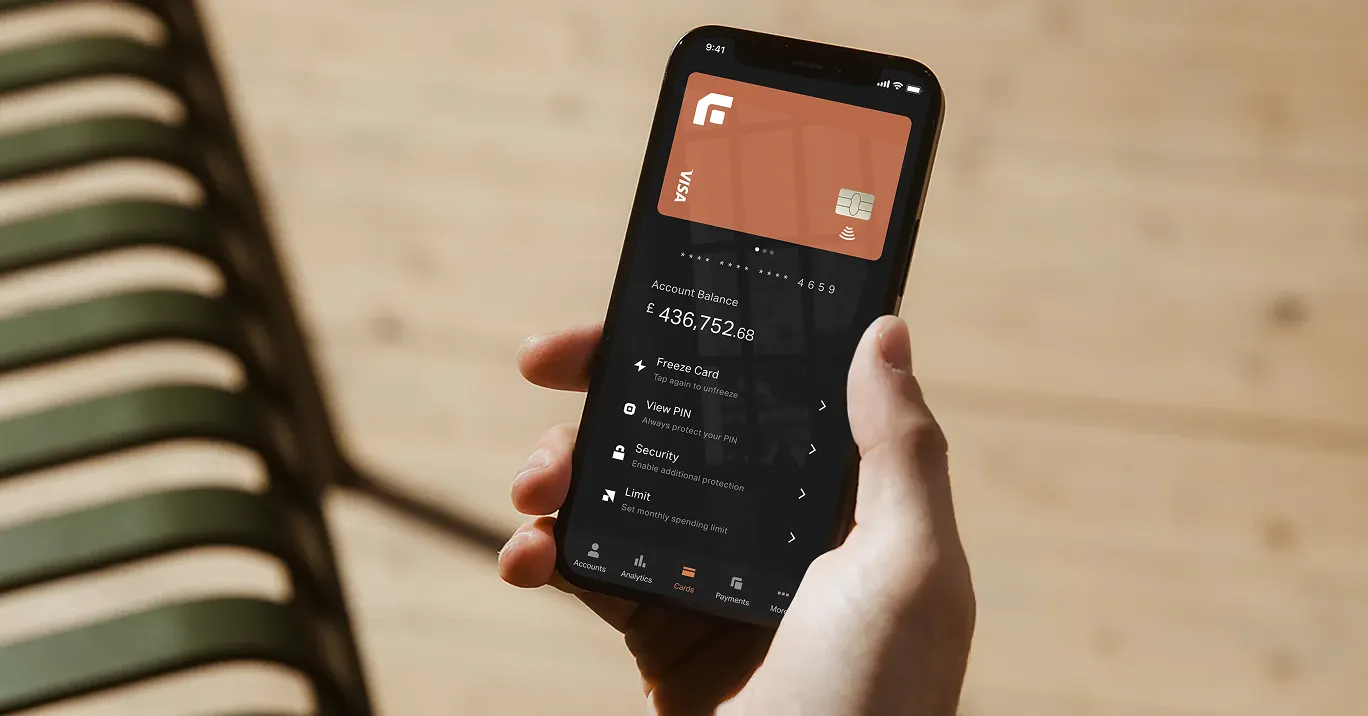

We defined and designed the minimum viable product (MVP), with the initial core user journeys – based on the identified market needs. Our team also developed a complete product brand with an Implementation-ready design system.

With a platform like this, users must securely connect multiple systems and data sources, such as their business bank accounts and accounting software. We dedicated a significant amount of thought and design into making this onboarding process as quick and painless as possible.

The outcomes

Supporting SMEs with an innovative Fintech platform

The client was extremely satisfied with the proof-of-concept, design and accompanying branding we created for the platform. With a solid business case, they are now equipped to tap into this new opportunity.

We defined and designed the minimum viable product (MVP), with the initial core user journeys – based on the identified market needs. Our team also developed a complete product brand with an Implementation-ready design system.

With a platform like this, users must securely connect multiple systems and data sources, such as their business bank accounts and accounting software. We dedicated a significant amount of thought and design into making this onboarding process as quick and painless as possible.